Cluster and Mirakl join forces to provide out-of-box marketplace catalog and assortment data for retail customers.

Continue readingCEO Chat on Changing the Product Data Catalog Ownership Story

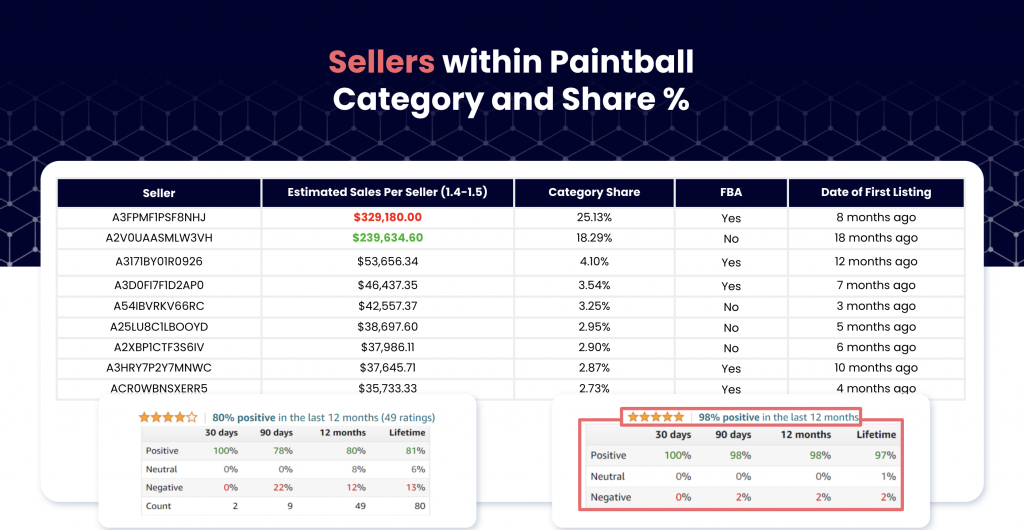

For eCommerce marketplaces, it’s always the same story: they rely on sellers to provide complete and accurate product data, but what if changing ownership were a possibility? What if marketplaces actually owned their own product catalog data and took the reliance off of seller inputs, while still being able to provide accurate product information for consumers?

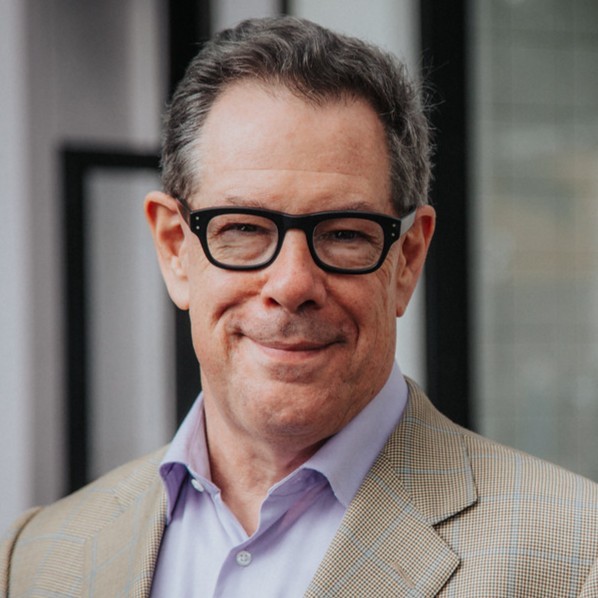

There are many roadblocks typically that prevent marketplace enterprises from achieving this outcome, but it is not an impossible feat. That’s why we caught up with Cluster CEO Ori Greenberg, in an interview to talk about the challenges, opportunities, and best practices for driving this industry to change. By transferring ownership of product catalog data from sellers onto marketplaces – success becomes possible for all parties involved, and below we dive into how and why.

Q: Who owns the product data catalog today in the eCommerce market and why? Is this the standard for most marketplaces?

GREENBERG: In the eCommerce marketplace landscape it always tends to be the same story. A marketplace starts by relying on sellers or merchants to provide product data, but quickly realizes it is a mess:

- The data is insufficient, and not normalized

- The marketplace catalog experience is bad for consumers.

- The marketplace catalog is underperforming in SEO and marketing in general.

- It is actually hard for sellers to list items and causes friction, sending 50% of them to abandon the onboarding process.

However, owning the product data catalog makes so much sense. The sellers can help, but the marketplace must own the process, the guidelines and the standards – to help your sellers comply with those standards.

And if you’re thinking this is not possible, this has been done successfully by enterprises like Amazon’s marketplace, and Google Shopping – and in looking at those examples, the results are clear. That being said, no one has the breadth that Amazon and Google have by themselves – and that’s why Cluster was created.

Q: What does the ideal marketplace product data catalog look like?

GREENBERG: The ideal marketplace product data catalog should be:

- Rich with structured product data.

- Detailed in taxonomy.

- Inviting, filterable and pleasant in every way.

Q: What is the best practice when it comes to ownership of the product catalog data?

GREENBERG: As mentioned earlier, marketplaces should own the catalog onboarding process, guidelines, and standards – and marketplaces need to help their sellers and merchants comply with those guidelines.

Q: Why is it so essential to follow these best practices?

GREENBERG: Loosening the rules on product data catalog ownership can cause a mess that spills into other business aspects across the board, and result in poor customer experience, bad seller experience, and poor performance overall.

Q: What are the roadblocks that keep marketplaces from gaining ownership of their product catalog data?

GREENBERG: Gaining ownership of your product catalog data is hard to set up, and taking the first steps can be difficult. You’ll ask yourself why would the sellers go through all the trouble to onboard their product information, and how do I even decide what to ask from them?

The reality is that it is a lot easier just to tell people, “Here you go – a platform – now just list your products! We’ll use Machine Learning and AI in the future to make sense of what you write!” And then you find out you can’t accomplish this, and the technology just isn’t there – but it’s too late. And, changing your practice becomes even more difficult.

Q: How can marketplaces work with sellers to create a mutually beneficial catalog onboarding process?

GREENBERG: First, marketplaces need to realize what data they need in order to provide a good customer experience and a frictionless seller experience. Next, help the existing sellers by adjusting their current catalog data. Provide clear guidelines on what is needed moving forward, and proactively help them provide the required catalog data. Examples of how to do this include:

- Pre-build a product data catalog. Start with top-of-mind categories,

- Match existing items with the ones in the pre-defined catalog.

- Provide matching tools for new products added to the catalog.

- Enhance items that are not in that pre-defined catalog on the fly using advanced tools and third-party data providers like Cluster.

Q: How does Cluster help?

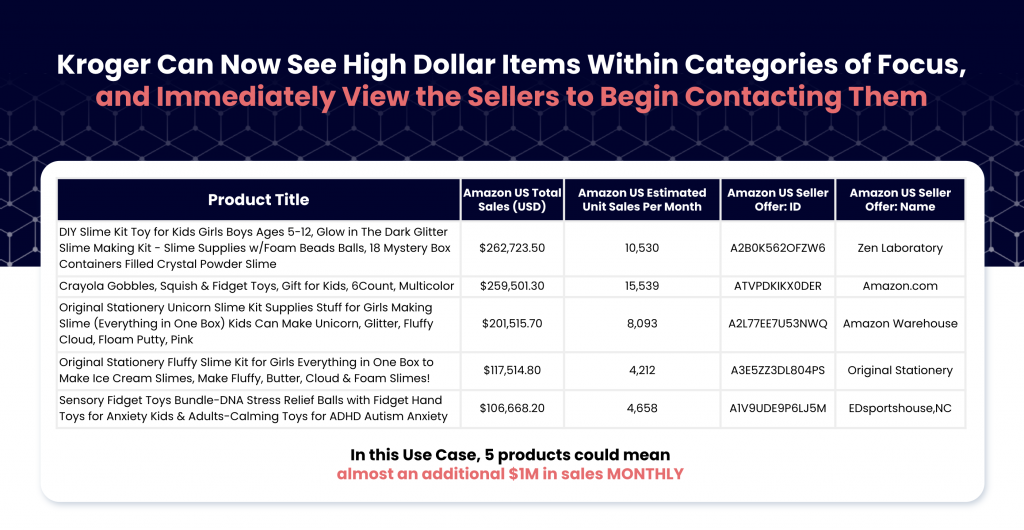

GREENBERG: Cluster is an eCommerce data provider that solves for creating a superior online shopping experience through quality catalog and product data for marketplaces and online enterprises (including adjacent markets like eRetail, brands, and financial institutions).

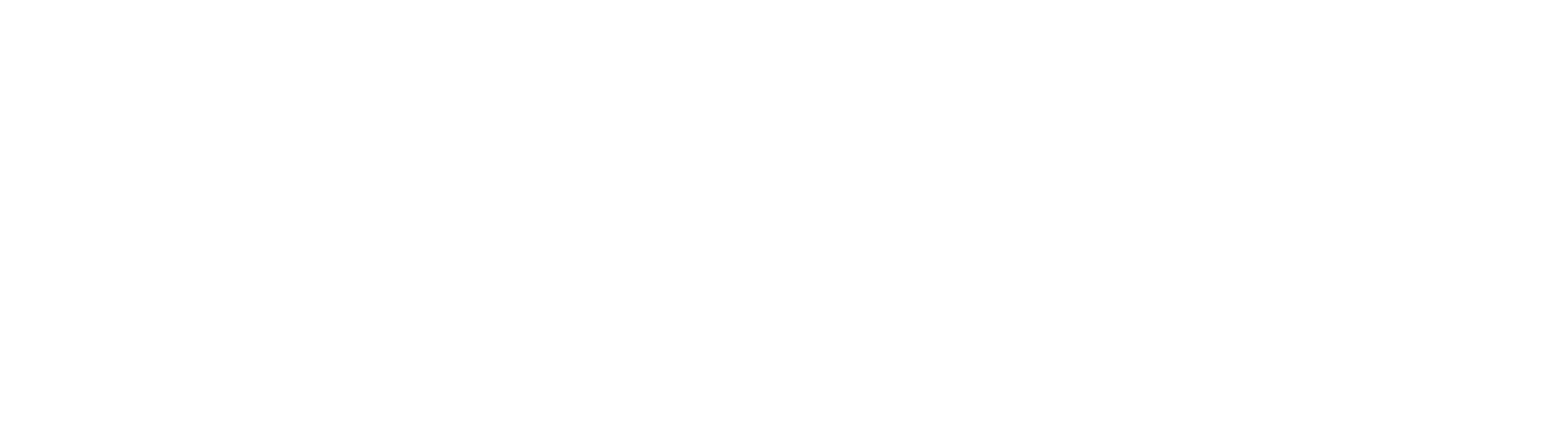

When marketplaces do not have a complete understanding of their product variants, they can oftentimes end up with duplicate listings, which confuses shoppers and in turn, sends them to competitor sites. Building a quality product data catalog is a challenge, but Cluster can identify, validate and enhance product data by matching duplicate products, so inaccurate information doesn’t find its way in front of your shoppers.

Q: What does the future of eCommerce marketplace data look like?

GREENBERG: No new marketplace can provide an Amazon-like experience, which consumers are now expecting, from the get-go without requiring any help. From the product data catalog to the fulfillment of orders, marketplaces will need to partner with industry-leading vendors to get ahead of the game.

Mutual Marketplace and Merchant Benefits

Changing the script of a story (especially in the middle) is not an easy task, but the results can make for a much happier ending. In this case, restarting can seem daunting but the mutually beneficial results for merchants, marketplaces, and ultimately consumers, can make a major impact on success. Talk with a Cluster expert today and see how our game-changing insights can work for you.

FUN FACTS

Little-Known Fact:

When time allows, I love to geek out with customers’ data. Even if the customer didn’t ask for anything, I love finding trends, data gaps, assortment gaps, and insights in general that are intriguing. Usually, I keep it to myself, but sometimes I can’t help but share it with the customer/account owner.

Quotes to Live By:

Be kind.

Favorite Marketplace:

For basic purchases, Amazon and Walmart. For fun, spontaneous or emotional purchases: Facebook Marketplace. I love the sustainability aspect, plus the fact I can ‘Uber’ a product my way in 20 minutes!

Favorite Snack:

Coffee.

Describe Cluster in 5 Words:

- Comprehensive

- Granular

- Accurate

- Unique

- Insightful

10 eCommerce Payment and Fraud Protection Strategies You Should Follow In 2023

Just because people can’t physically steal from online retailers doesn’t mean they can’t invade your business through fraudulent activities. In fact, about $20 billion in eCommerce losses were reported in the US — in 2021 alone.

If you manage or own an eCommerce marketplace, it’s absolutely crucial that you secure your business against online criminals with eCommerce fraud protection.

In this guide, we’ll tell you everything you need to know about eCommerce fraud prevention and 10 strategies that will keep your business safe.

What is eCommerce Fraud?

eCommerce fraud refers to when online hackers and scammers block and intercept transactions that happen in an online store. They can do this through a variety of methods that can steal money from either the merchant, the customer, or both.

As the world becomes more and more reliant on online transactions, scammers are finding new and creative ways to hijack customer data and commit fraud.

eCommerce fraud mitigation is not a one-time event. You must continually be vigilant and update your online platform’s security to keep up.

10 eCommerce Fraud Protection Strategies

Many business owners don’t begin implementing fraud protection for eCommerce until it’s too late. It’s always better to start being prepared and aware of different signs of fraud.

Let’s take a look at 10 different strategies that you can use for your online marketplace today.

1. Review Abnormal and Risky Orders

If you receive orders that seem odd or risky, it’s best to reach out to the customer to prove their legitimacy. Some examples of red flags include:

- Low-value orders from unusual IP locations

- Several orders placed in a row

- Different billing and shipping addresses

- Obscure shipping locations

- Abnormally large orders

If the customer doesn’t reply to your inquiry, there’s a good chance that the order was made from stolen data. You can also take a look at the customer’s order history to see if there are any odd patterns.

2. Limit Order Quantity

Orders that involve a high quantity of products can also be a red flag for scammers. You can up your eCommerce payment protection by limiting the number of products a customer can buy in a single day.

To do this, go back through your purchase data to determine the average number of products you typically sell. Then, set a limit to the number that can be sold at a single time based on this number.

3. Clearly State Your Business Policies On Your Website

It’s not only important to clearly state your policies for your customers to understand your business practices, but it’s also a way to help customers understand how to prevent fraud.

Some things your business should include are:

- A strong password policy to prevent scammers from hacking into customer accounts

- A return policy to clarify chargebacks and refunds

- Promotion and rewards policies to prevent fraud that may happen during promotions

The clearer you can make your policy, the better you’ll protect yourself against future fraudulent activity.

4. Use Address Verification Service (AVS)

Address verification system (AVS) helps verify your customer’s billing address with the card that they are purchasing with. This can help detect any suspicious transactions that happen in real time and increase price anomalies mitigation.

5. Require Card Verification Value (CVV) for Purchases

Requiring a card verification value (CVV) for purchases requires customers to add the three-to-four digit number as a required field. This adds an extra layer of security so that fraudsters can’t make purchases with just the front of a credit card.

This is one of the most popular forms of payment and fraud protection.

6. Use Other Verification Software

Although AVS and CVV are two of the most popular verification software out there, there are several others that you can use to enhance your eCommerce fraud management.

Some verification systems include:

- Email verification

- Customer Order History

- 3-D secure authentication

- Telephone number verification

- Postal Address Validation Services

- Blacklists

- Payment protection

These extra steps can help you secure your platform against fraud.

7. Conduct Regular Site Security Audits

Make sure to conduct audits on your website regularly. Go through all of your plugins and make sure they are updated to the latest version. Here’s an example of an audit checklist:

- Check if shopping-cart software is up-to-date

- Check if your SSL certificate is working correctly

- Check how often you are backing up your store data

- Remove any inactive plugins

- Update strong passwords for every account

- Regularly scan for malware

There are also several eCommerce fraud protection services available that can help take care of everything for you. Things are constantly changing in the online world. It’s important to keep up.

8. Avoid Collecting Too Much Customer Data

One general rule of thumb is to never collect more customer data than you actually need to run your business efficiently. If there is ever a data breach in your store, hackers will only be able to take the data that is there, so the less, the better.

Avoid collecting any sensitive data like Social Security numbers, birth dates, and more.

9. Use Hypertext Transfer Protocol Secure (HTTPS)

HTTP is the main protocol used to send data between a web browser and your store. HTTPS is the more secure version of it. It encrypts data which can protect sensitive information from hackers. Use HTTPS by purchasing an SSL certificate.

10. Avoid Non-Physical Shipping Addresses

Fraudsters often use PO boxes or other anonymous locations to avoid being detected or having their physical address found. Avoid shipping any orders to PO boxes or other virtual addresses to avoid any fraudulent activity.

Take Control of Your Marketplace

eCommerce fraud protection is an ongoing process that never ends. As long as you’re selling products on the internet and there’s money involved, hackers will try to find new and innovative ways to invade your store’s data.

If you’re an online marketplace looking to identify reputable sellers, detect fraudulent prices and remove suspicious listings before customers get to payment, book a free demo today!

Benefits of Product Matching in eCommerce

Just last year, retail eCommerce sales were an estimated $4.9 trillion worldwide. Over the next four years, it’s predicted to grow by 50% and reach almost $7.4 trillion by 2025.

Seems like a goldmine for eCommerce businesses, right?

Well, there are also anywhere up to 24 million online stores — and the number is steadily growing every single day.

It’s becoming more and more important for online businesses to find innovative solutions to stand out from the crowd. One recently popularized strategy is product matching.

This strategy is used to elevate the customer’s buying experience and stay competitive with other similar businesses.

Read on as we discuss everything you need to know about product matching in eCommerce and how it can be beneficial for both you and your customers.

What Is Product Matching?

Product matching is the term used in eCommerce when the same products are offered by different sellers in a single search result. This is done with the help of deep learning and a product matching algorithm.

To give you a better understanding, let’s take a look at the landscape of eCommerce right now. When people go shopping online, they’ll land on one of several different eCommerce platforms (whether they know it or not).

Some of the most popular platforms include:

- Magento

- Squarespace

- Shopify

- WooCommerce

- Elementor

- Wix

- 3DCart

Right now, more than 1.7 million merchants sell products on the Shopify platform. In 2020, Shopify processed more than $5.1 billion in sales.

With this in mind, it’s very likely that certain retailers are selling their products on several different eCommerce spaces throughout the internet. In other words, identical products are offered by different sellers on the same platform.

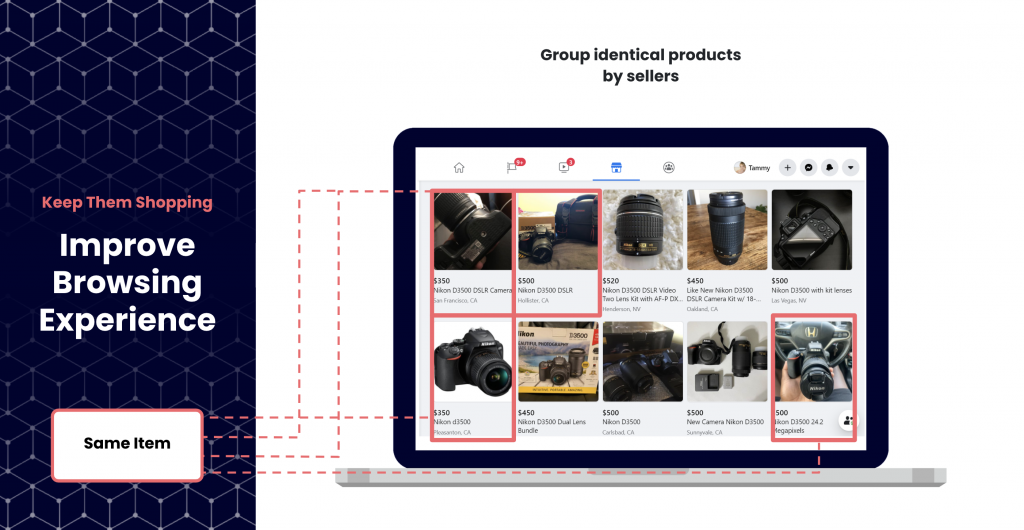

Through digital product matching, a seller can search for a product and see the same product being sold by the different sellers. From there, they can compare the price, quality, and other attributes, then make an informed decision to buy.

It’s like wanting to buy a new phone and walking into several different stores to see who has the best offer. The only difference is that you can do this online quickly and easily through matching products.

How Product Matching Benefits Both Sellers and Buyers

Product matching solutions are important for both the sellers and buyers in a transaction.

For the buyers, it creates an opportunity to compare several different options and choose the offer that works best for them. It’s more sophisticated than just choosing the lowest price, too. Let’s look at an example.

Let’s say a shopper is in the market for a new Bluetooth speaker. Two sellers are offering the same speaker for $50. However, another seller is offering the matching product for $55, but also offers a free one-month subscription to Spotify (a music streaming service).

Depending on if he or she is in the market for a streaming service as well, the second, more expensive option might be more attractive to our buyer than the first two options. If the first two are more attractive, the buyer can go deeper and take a look at the company, shipping costs, quality, etc.

Product matching is also helpful for sellers, too. It can be used to develop a pricing policy and keep them competitive with other businesses over time. They can easily learn about their competitors and figure out new strategies on how to stand out from the crowd (like offering a free month of Spotify).

It’s also important when they start building their offer, as well. They need to figure out how to name the product, what images to use, and what kind of copy they should write to describe the product.

For these reasons, product matching is incredibly useful for both parties involved.

Other Useful Benefits of Product Matching

Other than helping customers find the right products and sellers to compare their wares, product matching has other benefits as well.

Let’s take a look at a few.

Relevant Product Recommendations

Businesses can take advantage of product matching by simply suggesting related products to customers that are shopping online.

For example, let’s say that a customer is shopping for a new guitar online. He finally finds the perfect guitar and adds it to his shopping cart.

Through product matching, the system automatically recommends an amplifier and a cable to go along with it. The recommendation is just what he was looking for, so he purchases both products.

This can make product matching a powerful cross-selling tool.

Improve Product Listings

Through deep learning and name-matching machine learning, you can improve how your products are listed on your website.

The system’s analytics can help you learn more about your customers’ behavior, which will help you understand how to better rank products on your website.

For example, you can take a similarly matched store to your own and analyze their listings. The algorithms will give you insights into how your products are titled and described. This can help you find gaps and shortcomings in your product pages. For instance, you may find a certain page is missing vital keywords that could help you rank higher in SEO.

Detect Copyright Infringement

Most businesses spend tons of money and resources building their brand identity and designing a unique strategy. This applies to their visual content, the copy on their product pages, and the designs used on the website.

This is why it’s important to keep a close eye on copyright infringement. Through product matching, you can detect cases when other businesses are illegally stealing your designs.

Establish Competitive Prices

As mentioned above, product matching is an invaluable tool when it comes to forming product pricing. Through deep learning, you can automate pricing analysis not only when you first set prices, but over time as trends change.

Machine learning can lead to an increased profit that can’t be achieved through manual solutions effectively.

Get Real-Time Data Through Product Matching

Product matching is an invaluable tool that can help both retailers and their customers have top-notch experiences when they shop online.

Sellers can save time and get a positive ROI by utilizing deep learning to optimize their stores.

If you’re ready to start growing your store with the most accurate cross-channel eCommerce data in real-time, book a demo with us today!